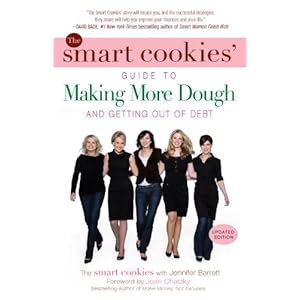

Student loans, credit cards, rent, bills, gas, new car, new apartment, 401k, all of these money issues can get a bit overwhelming, especially when you’re not prepared to take them head on. Luckily, a group of women, who refer to themselves as The smart cookies, have composed and shared The smart cookies’ Guide to Making More Dough to equip other women with the knowledge and the confidence to take control of their finances.

They start with the challenge of combating the taboo surrounding money. One cannot get to the root of the problem if it is not addressed directly. The smart cookies encourage the reader to have open and honest conversations about her finances with a select few who she truly trusts. What’s important here is choosing those you share a mutually trusting relationship with and those who will make as serious a commitment to their own finances as well as yours.

The recovery process starts with tracking every penny spent to see just where your money is going. Seeing the entire picture really puts everything into perspective. They also tackle the issue of getting to the root of why you spend money. Emotional spending, which most women can admit to being guilty of, is detrimental to financial well being.

In a friendly and encouraging tone, The smart cookies’ Guide empowers the reader to believe that eliminating her debt and taking steps further to improve her financial situation is very doable. They convey the message that it is not about giving things up and sacrificing everything you love to live a frugal life. It is, however, about making wiser choices, including shopping with sales and alternatives to outings. The “I rather” factor is rather intriguing. Friendly reminders like “I rather be in Paris in 90 days that have this cup of coffee today” help one accomplish long term goals as opposed to satisfying compulsive desires. What’s most beautiful about The smart cookies’ testimonials is their genuine support for each other’s progress.

In addition to helping the reader get control of her present finances they share ways to increase her finances by knowing her worth on her job and pursuing a career path that she love as well as investment strategies. In the book they also share a workbook for any reader to start her own money group to create a support team to reach all of her financial goals.

For Extra Credit (literally)

Other recommended readings include Glinda Bridgeforth’s Girl, Get Your Money Straight and Girl Make Your Money Grow, and Suze Orman’s Women and Money, which reinforce some of the same points but may also add some additional knowledge to your mental database.

No comments:

Post a Comment